Products and Solutions

INTRODUCING MONEY MOBILITY SUITE™

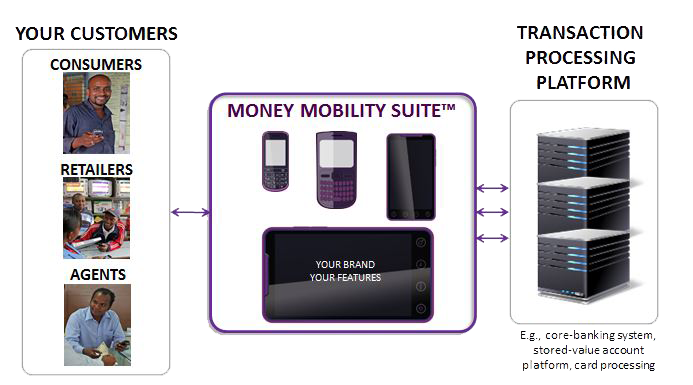

The mobile phone is revolutionizing the economics of financial services. Whether a financial institution, banking agent, retailer or mobile operator, you cannot afford to under deliver on your mobile offerings. If you are not serving these customers, your competition will. The Money Mobility Suite™ from Mistral Mobile eliminates the technological barriers to providing mobile financial services.

Money Mobility Suite™ works on any phone, on any network and anywhere—allowing you to reach and serve more customers, faster, and more cost-effectively than ever before.The Money Mobility Suite™ from Mistral Mobile gives you complete flexibility and control over your mobile services. With the Money Mobility Suite™, financial services can be delivered with the customers’ existing mobile phone whether the simplest or smartest mobile phone. No need for a data connection, or the latest smart phone technology. Critically, the platform integrates with your existing core systems, mobilizing any of your financial products and uses your brand.

- Reach and serve more customers than your competitors

- Works on any mobile phone

- Works with any mobile operator

- Works everywhere, with or without data connection

- Own your customers, no sharing required

- Be first-to-market every time with instant deployment tools

- Improve the customer experience and trust with your brand

- Reduce change request costs and delays with configurability

- Lower customer support through improved interfaces

- Lower telecommunication costs versus alternatives

- Reduce core system costs for operation and equipment

- Reduce risk with industry leading and patent pending security

Money Mobility Suite™: Managing the Complexity of Mobile

Mistral Mobile solutions remove the challenges of a constantly evolving marketplace by supporting every major mobile interface, for example: Android phones and tablets, Java-enabled phones, iPhone and iPad, BlackBerry, Windows Mobile, Symbian, voice-only phones and mobile browsers.

Mistral Mobile solutions built on the Money Mobility Suite™ modules include:

- m-Banking™ Solution – for retail banks offering consumer banking

- m-Agent™ Banking Solution – for retail banks, MFIs and co-operatives providing agent banking services

- m-Money™ Solution – for mobile money and payment service providers

- m-POS Solution – for merchant acquirers and payment service providers

Money Mobility Suite™: Return-on-Investment Advantage

Money Mobility Suite™ is designed by people who understand your business. As a result, Mistral solutions drive revenues more effectively and lower operating costs dramatically versus alternatives.

Key Benefits of the Mistral Money Mobility Suite™

- Beat your competition with a solution tailored to your business

- Reach more customers

- Own your customers

- Always be first-to-market

- Decrease your change request costs

- Remove the complexity of managing mobile software

- Ensure security with industry leading, patent-pending approach

M-BANKING SOLUTION™

Emerging-market bank account access solution enabling consumer retail banking services to everyone on their mobiles.m-Banking Solution™ is intended for banks or financial service providers offering mobile banking services for the retail customers. It enables the customers to use their mobile devices to use all the banking services via mobile channel.

- Allows serving 100% of population as any mobile device can be used

- Consumers online everywhere – even in rural areas as no data coverage limitations, and no No USSD nor SIM dependencies

- Fast adoption with an easy-to-use, icon-based user interfaces

- Zero-cost instant use case updates to all consumers devices with the Admin Console

- Easy integration to the core system, with modular architecture allowing system to grow as business scales

M-AGENT BANKING SOLUTION™

A complete Agent Banking solution to enable the rapid, cost-effective roll-out of agent services everywhere.

m-Agent Banking Solution™ is intended for banks offering agent-banking services, microfinance institutions and credit co-operatives. It enables the agents to use their mobile devices to perform all the customer servicing such as account opening, deposits, withdrawals and payments on behalf of the customers.

- Agents online everywhere – even in rural areas as no data coverage limitations, allowing serving 100% of population

- Fast adoption with an easy-to-use, icon-based user interfaces

- Increased customer confidence through SMS receipts

- Centralized agent commissions, velocities and fee management

- Zero-cost instant use case updates to agent devices with the Admin Console

- Easy integration to the core system, with modular architecture allowing system to grow as business scales

- No USSD nor SIM dependencies

M-POS SOLUTION™

Emerging market –specific retailer payment acceptance tools for fast scaling of the acceptance network.

M-POS is the fastest growing solution segment in increasing the card acceptance at the retail. Mistral Mobile works extensively together with multiple hardware vendors to bring unique MPOS solutions for highly cost effective increase in the card acceptance footprint in the markets.

m-POS Solution™ is intended for banks and other merchant acquirers providing retail payment services. It enables the retailers to use their their mobile devices for accepting payments from customers, converting their mobile devices into M-POS terminals with additional payment features.

- Low cost option to enable card acceptance network to scale across the total market – serving 100% of the card owner population

- Users are online everywhere – even in rural areas as no data coverage limitations, and no USSD nor SIM dependencies

- Fast adoption with an easy-to-use, icon-based user interfaces

- Zero-cost instant use case updates to all retailer devices with the Admin Console

- Easy integration to the transaction processing system, with modular architecture allowing system to grow as business scales